Direct Primary Care involves the patient paying a set fee per month. In other words, the physician receives a set amount of payment per member per month, a term originally associated with capitation. In short, the capitation model involves insurance companies paying physicians a set amount per patient/member per month. A physician draws from the monthly pile every time they see and treat the patient. More visits and tests, less money for the physician at the end of the month; less visits and tests, more money. While DPC and capitation share a set amount of money per patient per month, the payor and underlying psychology set the two models widely apart.

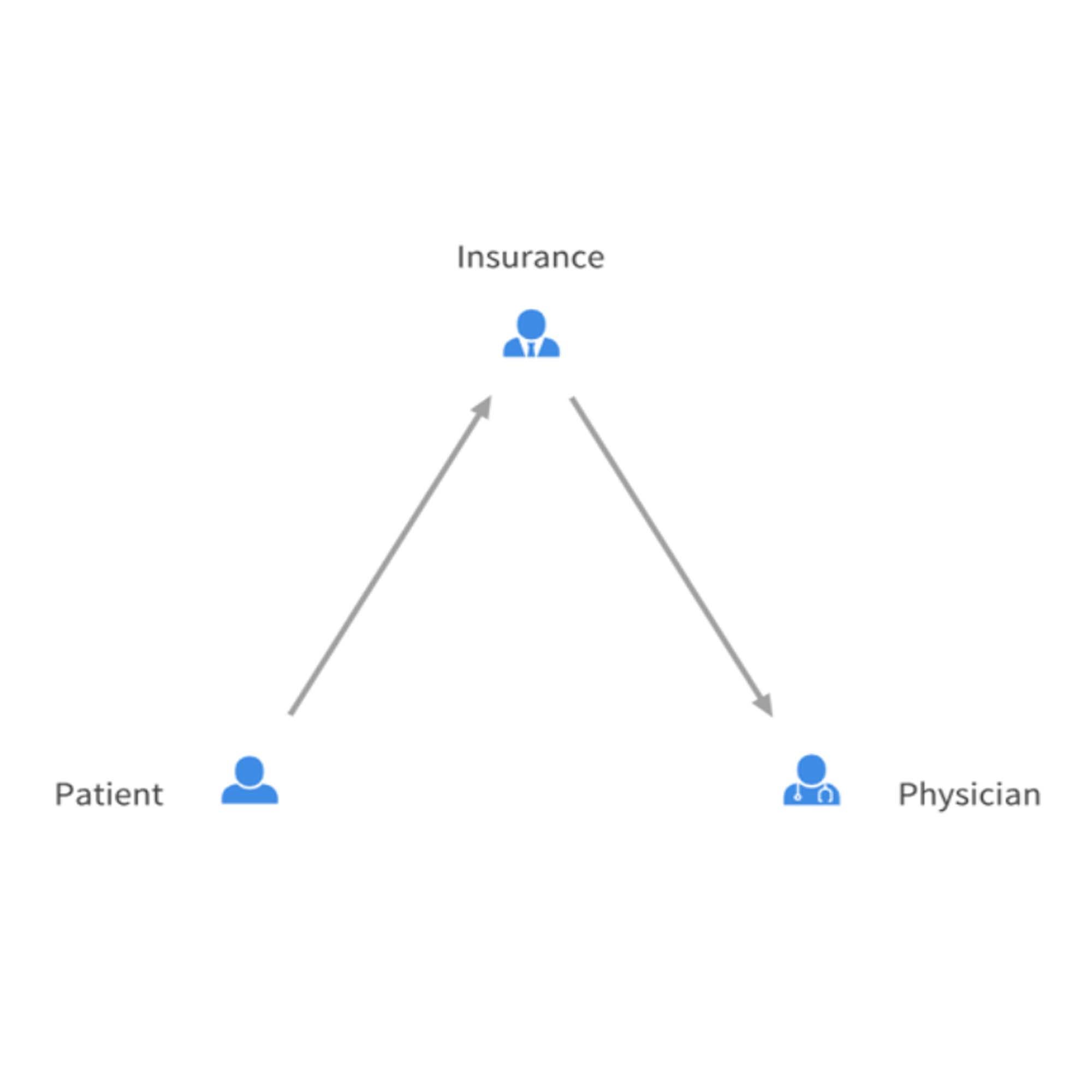

Capitation in its original form paired with HMO insurance plans is rarely seen anymore due to people quickly finding out how to exploit the model. Since the payor was insurance, the physician had no fiscal responsibility to the patient and as such only needed to play the game according to the rules set by the insurance company. The rules of the game allowed maximization of income by minimization of patient interaction. Patients found themselves shut out by physicians, having an increasingly hard time making appointments or noticing the quality of the physician’s office declining significantly. Another way capitation shielded physicians from financial loss in response to worsened patient care was the ability to stay in-network. As long as the physicians continued to accept the terms of an insurance company, the company would continue to recommend covered patients see the in network physician.

Medicare Advantage (MA) bundled payments are the newest iteration of capitated payments. Unlike the HMO capitated payments, the MA payments actually do the exact opposite and are currently fueling a feeding frenzy. Companies are popping up all over the place to take care of a select group of Medicare patients- specifically those who are “sicker” based on HCC (Hierarchical Condition Categories) codes. Most of the business model relies on savvy coding so patients appear as sick as possible, thereby receiving a larger monthly payment. These payments currently are so large that, even though the doctors only have panels of a couple hundred patients, the companies have enough revenue to build multispecialty centers with in house pharmacies and will often offer services such as free Uber rides or have iPad giveaways. No real harm exists with this model; in fact these companies take care of some actually very sick and oftentimes underserved populations. But based on a little knowledge of history and a grain of common sense, this golden goose will likely stop pushing out golden eggs and these companies may not.

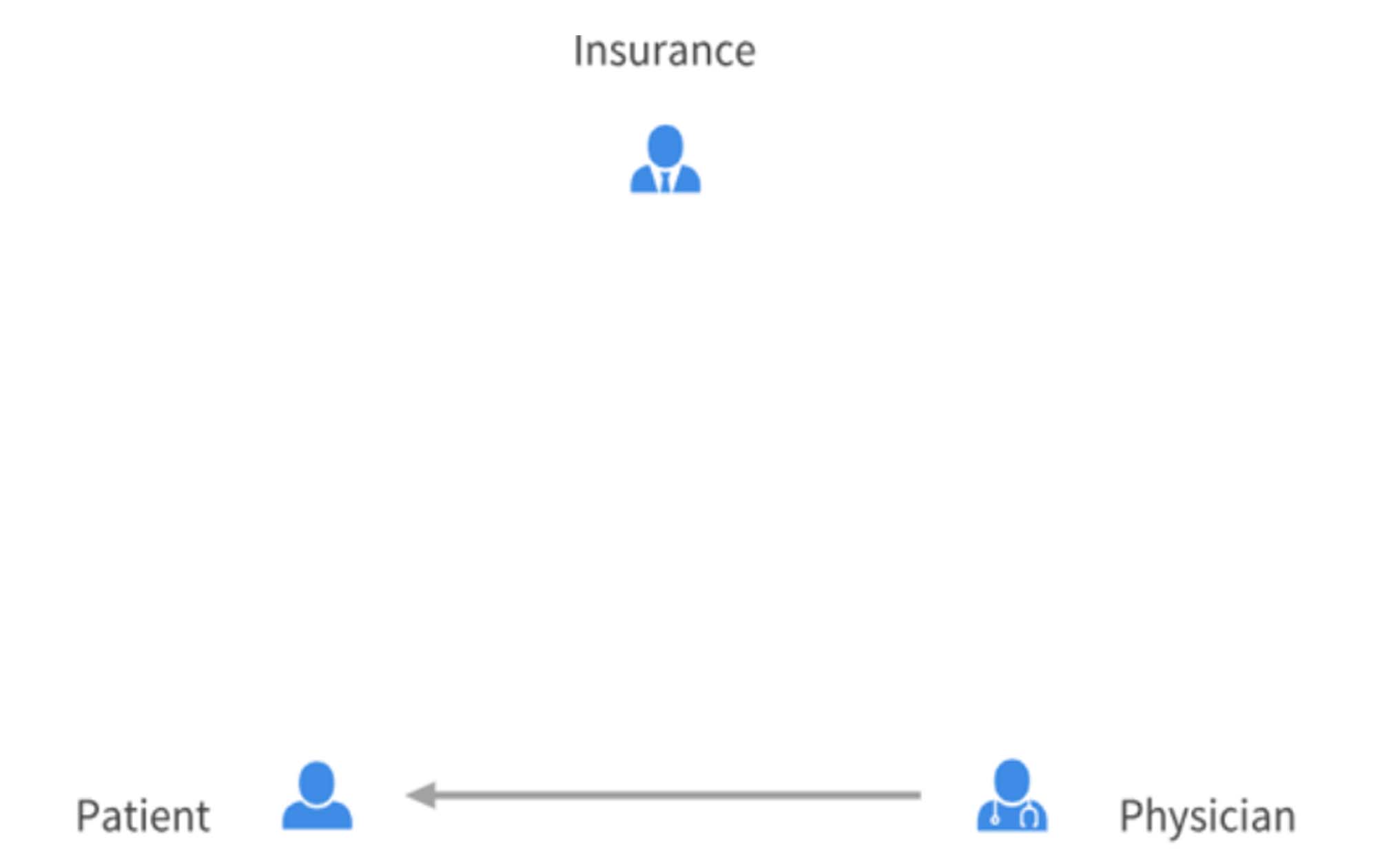

DPC fundamentally changes the rules by making the payor the patient rather than insurance, a third party. The financial risks and benefits now tie directly to patient care. Should the patient find the physician to not meet their needs, they will go elsewhere, taking their monthly fee and not giving the physician a guarantee of another patient to fill their spot. In addition, the physician loses nothing from treating the patient, while providing more value to patients who need more care. Market forces usually determine viable services. For example, if a DPC built free Uber rides into their monthly fee and patients found the service at the price appealing, then the practice would succeed. Third payor payments do not have the flexibility or intelligence in determining true needs and costs. Many payment reforms have come about due to abuse, such as mentioned with the capitation model. DPC gives little room, if any, for abuse as interests of patient and physician are aligned. While capitation and DPC can be made to sound the same, the fundamental difference, the core of DPC, is the direct relationship, medical and financial, between the patient and physician.

[…] DPC physicians believe primary care, as a routine, inexpensive service, does not need and should not need insurance coverage. Most will advocate for a DPC membership to be combined with a high deductible plan or an alternative product like a health share (e.g. Zion HealthShare) or CrowdHealth. Some companies, however, feel DPC can live in harmony with insurance, and can look like simple capitation plans which historically have had different incentives. […]